How to complete workplace pension re-enrolment and re-declaration in 4 simple steps

How to complete workplace pension re-enrolment and re-declaration in 4 simple steps

Auto-enrolment onto a workplace pension scheme first became mandatory for larger organisations with 250 employees or more in 2012. Since 2017, it also became compulsory for all sized businesses with at least one employee (not including director owners of their limited companies). This means that from the first day you hire an employee, you will need to automatically enrol them onto a workplace pension scheme by their first pay day. However, when it comes to auto-enrolment, your obligations as an employer do not simply end there.

How does a workplace pension scheme work?

The UK government required employers to begin auto-enrolment in a bid to encourage people to save for retirement and not solely rely on the state pension. Whilst you become eligible to receive a state pension by paying national insurance contributions, the workplace pension is separate to this entirely. It is funded by the employee through their salary, but also contributions made by you as their employer. Those who are self-employed and do not have any employees have no requirements to fulfil auto-enrolment, re-enrolment, or re-declaration duties, but are advised to consider setting up their own private pension fund.

To maintain a workplace pension scheme, employees are required to contribute a minimum of 5% of their monthly salary to the pension fund for the tax year 2023/24. Employers must also contribute to the employee’s fund and are currently obliged to provide a minimum of 3% of the employee’s monthly salary.

As an employer, you may wish to offer ‘pension contribution match’ which is seen as a generous non-taxable benefit. Pension contribution match means that should an employee decide to voluntary contribute more than the state-required minimum, the employer will match that amount in their contributions (usually up to a certain amount). However, all employees also have the option to opt-out of the workplace pension scheme and can do so by writing to the pension scheme provider. Nevertheless, you may want to point out the tax advantages of paying into a pension fund to encourage them to save for retirement.

What is re-enrolment and re-declaration?

Even if an employee does choose to opt-out, as an employer, you will have ongoing compliance requirements to complete either re-enrolment or re-declaration. Every three years, you must put certain members of staff back into an auto-enrolment pension scheme. This is what is known as re-enrolment. Re-enrolment occurs three years after your staging date or duties start date and is a legal duty whereby if you don’t act, you could be fined. Your duties will vary depending on whether you identify that you have staff to re-enrol, or whether you have no staff to re-enrol. Either way, you will need to complete a re-declaration of compliance to inform ‘The Pension Regulator’ that you have met your automatic re-enrolment duties.

What is a staging date or duties start date?

A staging date is applicable to all companies who had employees prior to 2017. It is the date which the Pension Regulator set as the deadline for employers to have a workplace pension scheme set up by as well as enrol all employees. Depending on the size of the company’s payroll, a different staging date was set. It was possible to bring forward the staging date if a company wanted to, but it was not possible to postpone the date. Failure to complete auto-enrolment duties by the staging date resulted in a fine.

However, if you are a new employer now, you will not have a staging date, but a duty start date. This date is determined by the date in which you hire your first employee and have them enrolled onto a workplace pension. From then on, every three years, you will need to complete re-enrolment and re-declaration.

How to complete re-enrolment and re-declaration

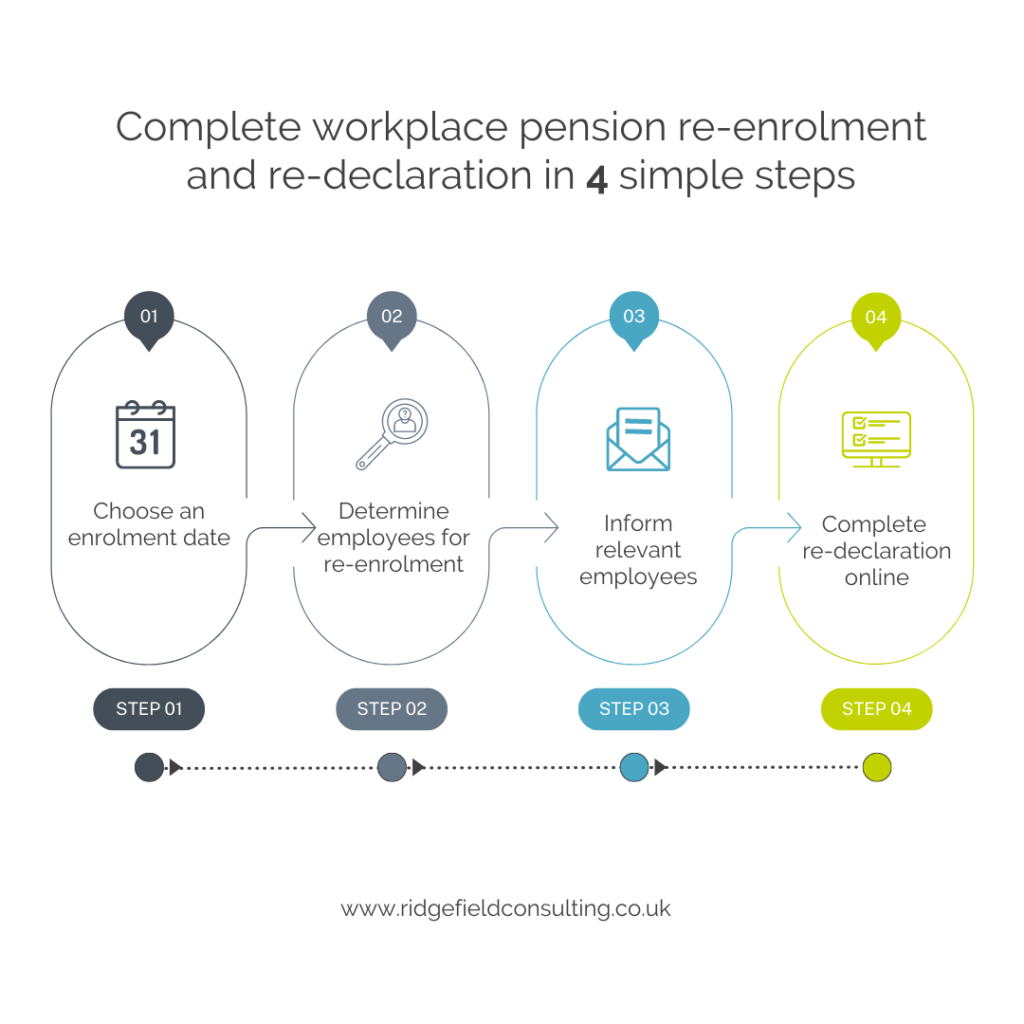

Completing re-enrolment and re-declaration is straight forward and can be done in 4 steps:

- Choose a re-enrolment date. Your re-enrolment date is a date chosen by you which becomes your deadline date every three years in which to complete re-enrolment. You have a 6-month timeframe to choose from, which is three months on either side of your staging date or duties start date. This date will apply to re-enrolling all employees who have opted out prior to this date, regardless of when they started employment or opted out. For example, your duties start date is 1 April 2018. You can choose a re-enrolment date between 1 January 2021 and 30 June 2021.

- Determine employees for re-enrolment. To prepare for completing re-enrolment you need to assess all your employees and establish which ones will need to be re-enrolled onto the workplace pension scheme. Only employees who have opted out will need to be considered. If you have any employees aged between 22 and the state pension age, who earn over £10,000 a year (or £833 a month, or £192 per week), they must be placed back into a workplace pension scheme.

- Inform relevant employees of re-enrolment. Once you have added any employees back onto a workplace pensions scheme, you will then need to inform them so in writing. This must be completed within 6 weeks after your re-enrolment date. It is best to take this opportunity to explain to these employees that it is a legal obligation for you to add them back on, but that they can choose to opt-out again if they wish.

- Complete re-declaration. The final step to completing the process is re-declaration. You must complete this step, even where you do not have any employees to re-enrol. Re-declaration is confirming that you have completed the assessment duties, re-enrolled employees if applicable, or state that you have no employees to enrol. To complete re-declaration online you will need your PAYE reference and either your lettercode or your accounts office reference number. You need to complete this step within 5 months of your re-enrolment date. If your re-enrolment date is 1 June 2018, you must complete re-declaration by 31 October 2021.

Monthly employer obligations for the workplace pension

To ensure you are keeping on top of all your pension obligations as an employer, each time you run your payroll you should carry out the following ongoing checks:

- Monitor the age and earnings of your employees. Once they are eligible to be placed onto a workplace pension, you will need to do so automatically. If they opt-out, then you will not need to review this until your next re-enrolment date.

- Pay the correct amount in employer’s pension contributions to their fund for any employees who choose to remain in the workplace pension scheme.

If you’re not sure how best to complete your ongoing payroll responsibilities, our article on payroll options will be helpful. Or to get some help now, get in touch to find out about our payroll service.

Stay up to date

Looking for some help?

You can find out more about our Payroll service.