What do I need to do for my bookkeeping?

What do I need to do for my bookkeeping?

When you’re running your own business, either as a sole trader or a limited company, one of the most crucial business responsibilities you will have is doing your bookkeeping. Not only is bookkeeping a legal requirement because you are obliged to keep financial records for up to 6 years should HMRC want to investigate or review your tax history, it is necessary for you to do in order to be able to complete your annual tax return (either personal tax return if you are a sole trader or company tax return if you operate as a limited company). Bookkeeping therefore, is a serious exercise which must be completed with careful diligence.

What is bookkeeping?

Bookkeeping is the process of recording every single financial transaction made by your business. Accurate bookkeeping will include logging any amount of money that comes into your business account, such as from making a sale, a client paying their invoice, or money received from a loan application. Equally, it will also include every transaction made where money leaves your account such as purchasing stock or equipment, paying salaries or dividends, or repaying loans. Bookkeeping therefore shows all movement of funds in and out of your business bank account at all times.

What is the difference between bookkeeping and accounting?

Bookkeeping and accounting are not the same things. However, because they are so closely related, it is not uncommon for many people to believe that they are. Nevertheless, the difference is considerable, and it is important to distinguish between the two. Bookkeeping is limited to the recording of a business’ finances. Whereas accounting will use the data collected as a result of accurate bookkeeping to interpret and analyse the information, make any necessary adjustments to comply with tax rules, and formally present the data in a standardised format for relevant stakeholders. This could include using bookkeeping data to complete a tax return form for HMRC, annual accounts for Companies House if you are a limited company, or even bespoke internal reports such as management accounts for shareholders.

Who needs to do bookkeeping?

Anyone who runs a business will need someone to do the bookkeeping. There is no legal requirement for a specific qualified person to complete this task, but ultimately, as the business owner, it will be your responsibility to ensure it gets done. It is not unusual for many business owners to do their own bookkeeping, especially where they are just starting up the business, the business is small, and there are minimal transactions that need to be recorded.

Another option is to hire a bookkeeper to do this for you. If you find yourself short on time, wanting to focus more on your business, or struggle to keep accurate detailed records, then this could be a reasonable solution. Using a bookkeeper will also be suitable for you if you simply want someone to keep on top of the records but are happy to file a tax return yourself.

Alternatively, you could use an accountant to complete your bookkeeping for you. Remember, just as bookkeeping and accounting are different, bookkeepers and accountants are different. It’s generally a good idea to use a chartered accountant if you require more support with your business. An accountant will be able to give you advice as to whether it would suit you better to operate your business as a sole trader or limited company, do your bookkeeping, and complete your tax returns for you. They’ll also be best suited if you want strategic tax and business advice, such as the best way to extract funds from your business or how to grow and be more profitable.

How to do bookkeeping?

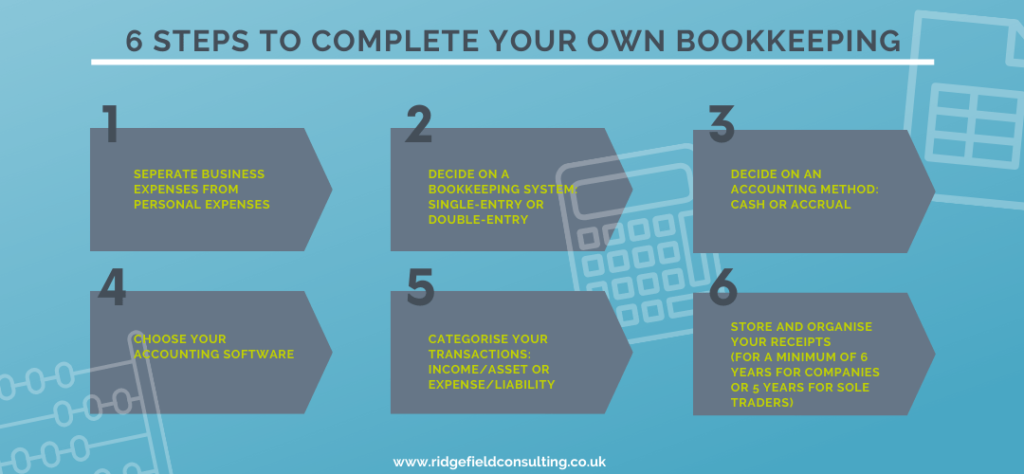

If you want to do your bookkeeping yourself, then the good news is that it’s relatively straight forward to do so. You’ll need to make a few key decisions as to how you would prefer to do your bookkeeping, but after that it’s down to keeping careful records and staying organised.

- Separate business expenses from personal expenses

This is a golden rule, regardless of whether you run your business as a sole trader or limited company. If you sell cakes as your business, you will need to know if you have purchased flour, butter and sugar for yourself at home or exclusively for your business. If you receive money into your bank account, you will need to know if it’s from a sale of your cakes or a friend paying you back money that they owe you. The best way to do this is to have separate bank accounts which will make things much easier for you. - Decide on a bookkeeping system

If you don’t know what a bookkeeping system is then that’s ok. You only have two options to choose from: single-entry or double-entry. Single-entry is where you only record your financial transactions once and they will either be income (money coming into your account) or an expense (money leaving your account). So, if you have paid for ingredients, tools, utilities bills etc these will all come under an expense. Money that comes into your account from sales will be income. Single-entry is usually the preferred system for those who are not as experienced with bookkeeping.

Double-entry is where every financial transaction is recorded twice because it gets logged as both a credit and a debit. Each credit and debit will need to be recorded in one of five different accounts: assets, liabilities, equities, revenue and expenses. For example, if you buy ingredients for your cake business this will need to be recorded as a debit in expenses and a credit in assets (because your bank balance will decrease as a result of paying for the ingredients). If you take out a loan for your business this will be recorded as a debit in your assets (because your bank balance will increase) but a credit in liabilities (because you owe money to the lender). The double-entry method can seem much more complicated; however, it is also much more difficult for errors to occur. - Decide on an accounting method

Again, you have two options to choose between: cash or accrual. Cash accounting is best suited if you are using the single-entry bookkeeping system. Using the cash accounting method means you only make a record of a transaction when money comes in or goes out of your account. Using the accrual method is better suited to the double-entry bookkeeping system and instead records transactions as and when they have been issued. This means that you would record income as accounts received when you issue a client or customer with an invoice, even though they may not have paid you yet. Similarly, you would record accounts payable when you receive a bill yourself, but may not have paid it yet. - Choose your accounting software

With the ongoing-roll out of Making Tax Digital, the government are requiring more and more people to complete their taxes digitally. It is therefore a good idea to start using accounting software now to complete your bookkeeping so that you have adequate opportunity to get used to it before it becomes mandatory for you to do so. There are various digital accounting software to choose from, paid and free, but you should ensure that whichever you use is HMRC-approved.

If you are not required to use accounting software and would prefer not to, then you can use a simple excel spreadsheet instead to keep a track of your ingoing and outgoing transactions. We would not advise anyone to complete their bookkeeping on paper as you are much more at risk of making a mistake or damaging or losing your records. Whilst you may find an excel spreadsheet more convenient for you, don’t forget that a good accountant will be able to support you in getting started with using accounting software to help you futureproof your business - Categorise your transactions

Once you have chosen your bookkeeping system, your accounting method, and the tool which you’ll use to complete your bookkeeping, you can start to keep your records. Not only should you make a note of the date of when the financial transaction occurs, the amount that is either income/asset or expense/liability, you should also categorise the transactions. If you record money received as income, you should mark whether it is due to a sale, a refund, investment received, or some other reason. It is especially important to categorise your expenses as some may be tax-deductible but not all. This is important when the time comes to complete your tax return because categorising your expenses accurately will enable you to see where you can reduce your tax bill. - Store and organise your receipts

You are legally required to keep all your financial records for a minimum of 6 years (this applies to limited companies. It is reduced to 5 years for sole traders). HMRC expects that keeping your records will also include your original documentation such as receipts. Whilst you may think that keeping all your receipts in a shoebox may be a simple solution, it may not be the best as you can find that receipts will often fade over time.

An alternative solution is to ensure you keep digital copies of these receipts. You can do this by scanning your receipts and saving them onto a USB stick, or even uploading them onto cloud storage such as Dropbox or Google Drive. Depending on the number of transactions you make for your business, this could end up being incredibly time consuming. If you need a more efficient solution, you could try using mobile apps which not only allow you to take a photograph of the receipts and store them, but it will also transfer the information from the receipt direct into your accounting software.

How often do I need to do bookkeeping?

There is no rule that dictates how often you need to be doing your bookkeeping. Instead, it is likely to be governed by the number of transactions your business has and your own personal preference. For example, if you run a restaurant and will likely have a high number of transactions going through each week, it may make sense for you to do weekly bookkeeping. However, there is nothing stopping you from doing your bookkeeping monthly if you instead prefer to dedicate a set amount of time to go through it all in one go. However, if you run a business where you only invoice clients on a monthly basis and have little expenditure, then it may be more convenient to do your bookkeeping monthly or even quarterly. So long as your finances are all getting recorded accurately, it does not matter how often you are doing your bookkeeping. Be aware though, that if you need regular reports to keep an eye on how your business is performing, then your bookkeeping will need to be up-to-date in order to be able to produce accurate management accounts.

When is my bookkeeping due?

When your bookkeeping entries and totals need to be updated will depend on your filing deadlines. If you are a limited company, they will be due by the time you need to complete your annual accounts and company tax return. If you are VAT registered (either as a sole trader or limited company) then they will need to be up-to-date for your VAT return which can be either monthly, quarterly or annually depending on your business. If you’re a sole trader then your bookkeeping must be complete by the time you come to file your self-assessment tax return. These dates can be difficult to keep up with, or spring up on you faster than you expect. If you need extra support to manage your bookkeeping so that you’re ready for when all these deadlines approach, speak to us to see how we can tailor our bookkeeping service to your business.

Stay up to date

Looking for some help?

You can find out more about our bookkeeping service.