How does VAT work?

How does VAT work?

Value-added tax, or VAT as it is more commonly referred to, is a consumption tax charged in the UK. It is paid for by all consumers and collected by VAT registered businesses who must then pass this tax collection onto HMRC. VAT accounts for being the third biggest income generator for the UK government, after income tax and national insurance contributions. Together, all three raise over half the government’s tax receipts.

What is VAT charged on?

VAT is described as form of consumption tax because it is applied to almost all products and services you would use. However, it is not always clear when you have been charged VAT, on what, and how much because there are different rates of VAT that apply depending on the type of item or service. The most common example of where it can be difficult to determine when VAT has been charged is during activities such as shopping at a supermarket. The government only apply the standard rate of VAT on non-essential items. Some of the most crucial necessities such as medicine or medical treatment are exempt from VAT completely. Most food items are deemed essential (excluding luxury food items such as ice cream and chocolates) and are therefore charged at much lower VAT rates. On the other hand, everyday items also bought at a supermarket which are likely to be considered as essential items, such as toothpaste or toilet paper, are not charged at the same lower rate of VAT as food items. The distinction between essential and non-essential items is therefore an unreliable gauge as to when VAT is charged and how much.

What are the different VAT rates?

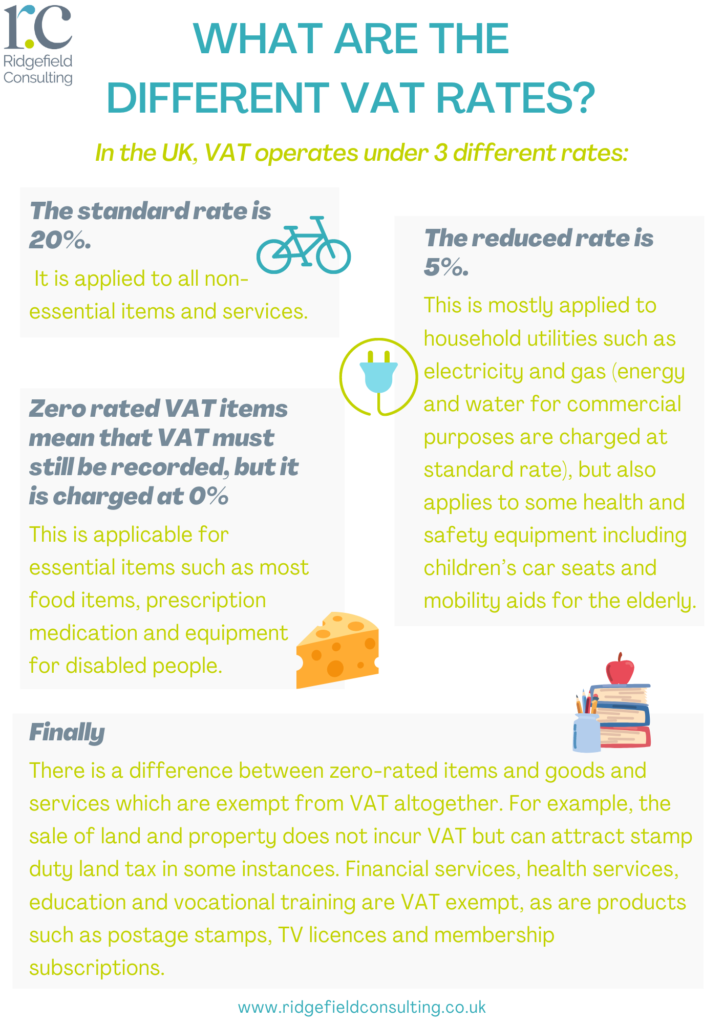

In the UK, VAT operates under 3 different rates:

- The standard rate is 20%. It is applied to all non-essential items and services.

- The reduced rate is 5%. This is mostly applied to household utilities such as electricity and gas (energy and water for commercial purposes are charged at standard rate), but also applies to some health and safety equipment including children’s car seats and mobility aids for the elderly.

- Zero rated VAT items mean that VAT must still be recorded, but it is charged at 0%. This is applicable for essential items such as most food items, prescription medication and equipment for disabled people.

Finally, there is also a distinction between zero rated items and goods and services which are exempt from VAT altogether. For example, the sale of land and property does not incur VAT but can attract stamp duty land tax in some instances. Financial services, health services, public education and vocational training are VAT exempt, as are products such as postage stamps, TV licences and membership subscriptions.

What are VAT rate conditions?

The above VAT rates can only be applied on top of the cost of the goods and services under certain conditions, depending on some or all of the following:

- who’s providing or buying them

- where they’re provided

- how they’re presented for sale

- the precise nature of the goods or services

- whether you obtain the necessary evidence

- whether you keep the right records

- whether they’re provided with other goods and services

This is not an exhaustive list and other conditions may apply because the UK VAT system is incredibly complex, with no one source that outlines all the criteria and rules. Some industries have their own rules when it comes to VAT such as for builders or charities.

One of the clearest conditions is that VAT can only be charged by a VAT registered business (irrespective of whether the business is operating a limited company or sole trader). You may often find that small or independent businesses do not charge VAT because they are not required to do so until they reach a certain threshold in turnover. This means that you may be able to receive products and services VAT-free (where they would normally incur VAT) if provided by a non-VAT registered business. Examples of this include using a plumber who is not VAT registered or purchasing made-to-order curtains from an independent non-VAT registered business.

How is VAT charged?

When a business charges VAT, they will take the ‘net’ cost (the original cost of the product or service without tax) and multiply it by the correct rate of VAT that applies. They will then add this amount on top of the net cost which is the price you will need to pay as a consumer, and this is referred to as the ‘gross’ price.

In the UK most goods and services are automatically charged at the gross price. On bills and receipts, you should see a separate line which shows the total amount of VAT that has been charged. This is not an extra amount that you have to pay but shows how much VAT has been included in the overall price. On invoices from VAT registered business, they must not only show a separate amount for VAT but also their VAT registration number.

When it comes to prices you see before paying for a product or service (for example on adverts, catalogues, or price lists), you need to make sure you understand the final cost or gross cost. Usually if an item or service is for the general public the cost will automatically include VAT. However, if it is for both the general public and VAT businesses, then they may show two prices – one which is the net price, and then the VAT amount so you may need to add both together for the final cost to you as an individual. Alternatively, products or services which are intended for other businesses only often show a price without VAT completely. It is then charged on top. This is because they assume they are trading with other VAT registered businesses who will reclaim their VAT payment.

How does VAT work for businesses?

VAT registered businesses are required to file regular VAT returns to HMRC. How often a VAT return needs to be completed will be dependent on the VAT scheme the business chooses to use (we can advise on which would be most advantageous or convenient for you). By completing a VAT return, the business declares how much VAT they have paid on goods and services they have received, as well as how much VAT they have charged their customers. If they have received more VAT from their customers than they have paid out, then the difference needs to be paid to HMRC. However, if it is the opposite and they have paid more VAT in goods and services than they have received from customers, then they can claim a refund from HMRC.

Who needs to register for VAT?

If you are trading, either as a sole trader or limited company, and your VAT taxable turnover reaches £90,000 or more, then you must legally register for VAT. Your VAT taxable turnover is the total amount of everything you have sold, or services provided which are not VAT exempt. It is important to be aware that your turnover period for VAT is calculated as a continually rolling 12-month period. This means that if you are likely to go over the threshold within the next 30 days, then you should consider registering for VAT. Failure to register for VAT in time will result in significant penalties.

Who is exempt from registering for VAT?

Not all businesses have to register for VAT. Those businesses who are under the VAT threshold have no legal obligation to register. However, they are still able to register voluntarily if they wish to, and this may be advantageous for some businesses. By doing this, it means they will then take on the regular responsibilities of filing VAT returns and making VAT payments to HMRC.

Some businesses can apply to not register for VAT even where they go over the VAT threshold. This is only possible in limited circumstances where the turnover is only expected to be over the threshold temporarily and is an exception to the norm for the business. In this case, the business can write to HMRC and provide evidence that the VAT taxable turnover is unlikely to go over the deregistration threshold of £83,000 over the next 12 months. If HMRC accept the application, they will write back to the business confirming that they are eligible to receive a one-off exception to registering for VAT.

Other businesses are exempt from VAT regardless of their turnover because they sell goods or provide services which are VAT exempt. This means they cannot register for VAT even if they want to. They may have to purchase goods or services upon which they are charged VAT, but they would not be able to reclaim these VAT payments. Common examples include:

- Insurance finance and credit

- Education and training

- Admission fees charged by charities including fundraising events

- Subscriptions to membership organisations

- Selling, leasing and letting of commercial land and buildings

- Health services provided by registered health professionals such as doctors, dentists, opticians and pharmacists

It is important to distinguish between businesses which are VAT-exempt to businesses which sell goods or provide services which are 0% rated. Those which are 0% rated must still register and complete regular VAT returns.

If you’re unsure as to whether you need to register for VAT or not, whether you work as a sole trader or limited company, get in touch for a introductory call to discuss your position.

Stay up to date

Looking for some help?

You can find out more about our VAT return service.