How to claim R&D Tax Credits

How to claim R&D Tax Credits

UPDATE: Please refer to our latest article for the most recent 2023 changes to R&D tax credits.

If you’re investing in a business project where you undertake research and development in order to build or substantially improve a new product or service, then you’ll want to make sure you learn how to claim R&D tax credits. R&D tax credits is a tax relief scheme offered by the UK government to encourage innovation and is open to most industries. It enables you to claim for an enhanced percentage of money spent on your projects back as either a corporation tax reduction, cash, or a combination of both. If you’re unsure of how much you could claim back or are wondering if it’s worthwhile then you can find out about how R&D tax credits work for small businesses first.

Who can claim for R&D tax credits?

Only businesses that are liable to pay corporation tax can claim R&D tax credits, and therefore excludes sole traders and partnerships. What’s more, for the SME R&D tax credit scheme, companies will only be eligible if they qualify as a small to medium-sized enterprise which is measured by having less than 500 employees and a turnover of less than €100 million or a balance sheet of less than €86 million. Companies claiming for R&D tax credits must be based in the UK although the actual R&D activities do not have to take place in the UK.

What counts as an R&D activity?

A further eligibility requirement to being able to claim R&D tax credits is that your company must be carrying out a qualifying research and development activity (or project). There are two tests which must both be met to establish this:

- There must be a technological advance.

This terminology often alienates a lot of small businesses who may not believe their work amounts to research or development, especially if they are in a sector which is not stereotypically regarded as ‘technological’. However, ‘technological advance’ simply means that the work you are carrying out has the objective to create something new or considerably improve upon something which currently exists. The emphasis on technological advance is also placed on the process of carrying out the research and development rather than the outcome. This means you could be creating a product, service or process which already exists in your industry, but you are doing so in a completely new way that has not been done before. - There must be a technological uncertainty.

There are two ways to demonstrate technological uncertainty, and either way can be met to qualify, or even both. The test for technological uncertainty simply means that what you are trying to achieve is not already commonly known to be possible in your sector or could not be easily worked out by a competent professional in your field of work. If what you are trying to do has already been done before but is a trade secret and so therefore not commonly known in your industry, this will still qualify. You can show technological uncertainty by explaining how the potential product, service or process may not work how you intend for it to, or that the potential product, service or process will work as you intend, however you are not sure how to achieve it. Regardless of whether your research and development project is successful, you can still claim R&D tax credits.

How to claim R&D tax credits

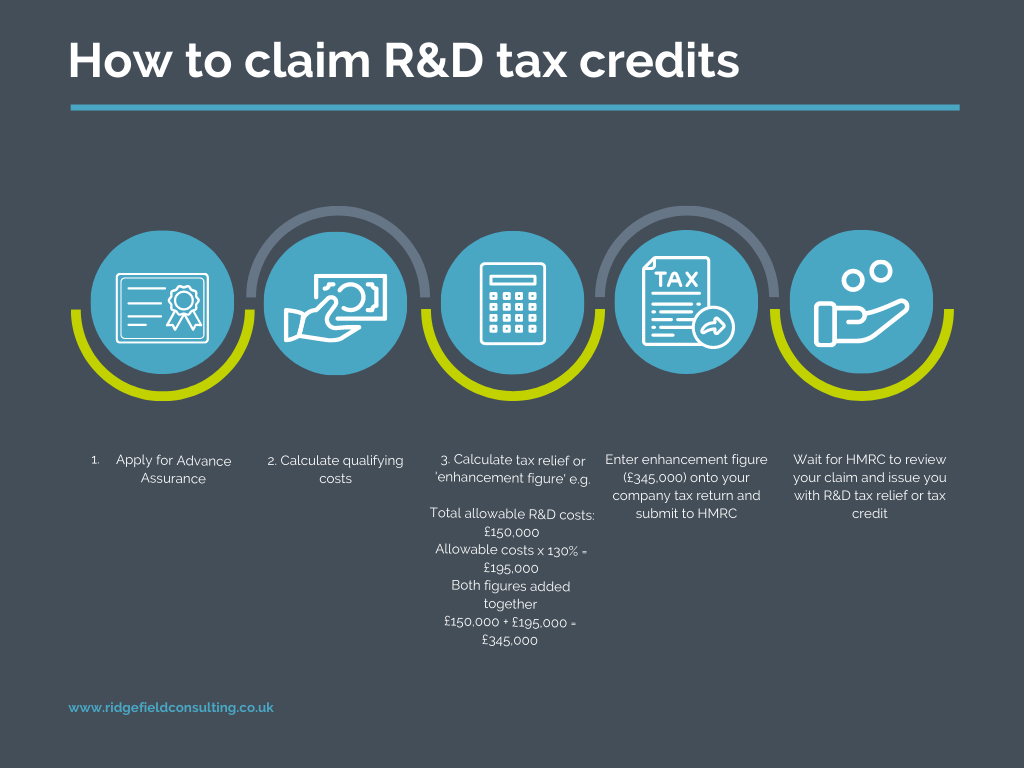

If it is the first time your company is claiming for R&D tax credits, then you may want to consider applying for Advance Assurance (AA). Obtaining AA is optional but will allow for your claims to bypass any potential investigations that HMRC may instigate during your first three accounting periods. It is for this reason that we would highly recommend doing so as it will significantly increase the efficiency of your claim and speed up any payments.

First, you will need to calculate your qualifying costs. To claim R&D tax credits you will need to provide a breakdown of eligible costs. HMRC will want to see exactly how much money the company has spent, and on what, before they will issue a tax refund. Do not forget to accurately account for costs that need a percentage proportion applied to them such as utilities, as this is one of the most common pitfalls companies fall into that can invalidate their R&D claim.

Once you have your total eligible costs, you can calculate your total tax relief. This calculation is referred to as the ‘enhancement’. For the SME R&D tax credit scheme it is calculated by multiplying your total allowable costs by 130% and then adding that to the original total allowable cost for a combined total of 230%. An example of this would be:

- Total allowable costs – £150,000

- Allowable costs multiplied by 130% – £195,000

- Two figures added together for ‘enhanced expenditure’ total – £345,000

This figure then gets entered onto your company’s tax return. Put an X in box 650 of the company tax return form and the enhancement figure in box 660. HMRC will then review your claim and issue you with your R&D tax credit relief.

How much will I receive from my R&D tax credit claim?

How much you receive from your R&D tax credit claim is not only based on your eligible expenditure but also on whether your company is profit-making or loss-making. There can be a misunderstanding for companies who are claiming R&D tax credits for the first time as they may believe they can receive the full enhancement figure back, which is not the case. Instead, different rates are applied depending on your company’s tax liability. Referring again to our example company with R&D spending of £150,000, we consider four scenarios:

- Your company is profit-making with a corporation tax liability of £50,000.

You claim R&D tax credits on £150,000 worth of eligible expenditure.

You will receive 19% of the enhancement figure (£195,000) as corporation tax relief.

You therefore reduce your corporation tax by £37,050 and only need to pay £12,950 in corporation tax. - Your company is profit-making with a corporation tax liability of £25,000.

You claim R&D tax credits on £150,000 worth of eligible expenditure.

You will receive 19% of the enhancement figure (£195,000) as corporation tax relief.

Your entire corporation tax liability is cleared with £45,000 virtual losses (“enhanced losses”) remaining on your tax return. You can either choose to receive 14.5% of the remaining losses in cash (worth £6,525) or carry the amount forwards to offset against future profits, creating a future tax benefit worth 19% of £45,000 = £8,550. - Your company is loss-making with total losses of £150,000.

£150,000 was spent on R&D work. You choose to receive tax credit (cash) instead of tax relief (corporation tax reduction). This allows you to claim 14.5% of your enhanced R&D expenditure (£345,000) which is worth £50,025. - Your company is loss making with total losses of £150,000.

£150,000 was spent on R&D work. You choose to carry forward the loss to offset against future profit (and therefore a corporation tax liability). This allows you to carry forward 19% of your enhanced R&D expenditure (£345,000) which is worth £65,550.

What to do if you can’t claim SME R&D Tax Credits

If you’re unable to claim from the SME R&D tax credit scheme, due to your company’s eligibility, but you are still carrying out R&D work, then you may want to try using the Research and Development Expenditure Credit (RDEC) scheme. Typically, this scheme is available for larger companies and is less generous, offering 13% of your qualifying expenditure as tax relief. However, it can also be used by SME companies if they are prevented from claiming from the SME R&D Tax Credit scheme.

How to avoid being prevented from claiming SME R&D Tax Credits

One of the biggest mistakes small companies make that will prevent them from claiming R&D tax credits is to not strategically plan their funding for their R&D projects. Funding opportunities can be hard to come by, and so, although you may not want to miss out on a potential opportunity to receiving funding for an R&D project, you should take a step back and assess how you can safeguard your work so that you can continue to use various lucrative innovation funding options. To avoid being prevented from claiming SME R&D tax credits, we recommend learning about the difference between notifiable and non-notifiable state aid as it will explain how schemes such as SEIS and EIS, as well as business innovation grants affect your ability to claim R&D tax credits.

Get help with claiming R&D Tax Credits

Getting help for your R&D tax credit claim from experts can be the most efficient way to claim. It can give you peace of mind that you’re claiming for every eligible expenditure, as well as help make sure you’ve got the strongest possible technical report to convince HMRC of your claim. Ridgefield Consulting offer a full package of support when it comes to R&D tax credits, from helping your claim AA to completing your company’s tax return to claim for R&D tax credits. What’s more, our experts are on hand for any advice you may need regarding other innovation funding options such as SEIS or EIS, business innovation grants and EMI share schemes and how they may affect your claim. To find out about our fixed rate fees with no contractual lock-ins, discuss your projects with our team by calling 01865 24 55 11 or using the online contact form.

Stay up to date

Looking for some help?

You can find out more about our R&D Tax Credits service.