How to extend your filing deadline: A guide for limited company directors

How to extend your filing deadline: A guide for limited company directors

Quick Links

Listen to our podcast version of this article:

Squeezed for time to file your accounts with Companies House? Don’t worry, you’re not the only one. It’s not uncommon for many first-time company directors to become overwhelmed with the multitude of compliance, tax, and accounting obligations that need to be completed – all with their own individual due date. Even if you’re already a company director running your own business by yourself, life and work gets busy, and deadlines easily creep up. If you need a bit of breathing room, then we’re here to help. Our guide on how to request an extension for your filing deadline is going to be a real lifesaver. Here’s how to extend your filing deadline:

But first, what accounts?

Statutory accounts, which are also known as annual accounts or yearend accounts, all refer to the same thing. They are a set of reports which show how your company has been performing over a set period (usually a year) and includes integral financial information such as how much you’ve spent investing and running your business as well as how much profit you have made. Your statutory accounts need to be submitted to Companies House once a year (as well as included as part of your company tax return for HMRC).

When are my accounts due?

Every company has their own deadline for their statutory accounts which is based on the company’s accounting reference date. Your accounting reference date is 12 months from the last day of the month of when you first incorporated with Companies House. Your deadline date is 9 months after your accounting reference date. The exception to this is if you are filing your statutory accounts for the first time, as you’ll automatically receive an extension and have up to 21 months from the date of your incorporation to file.

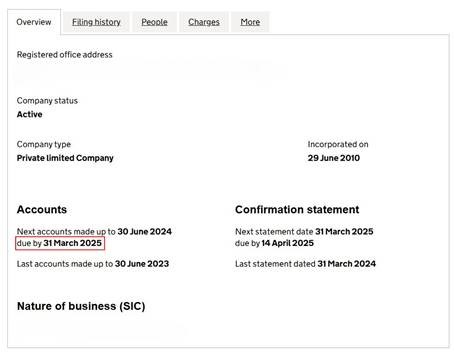

Is there any way to check when my filing deadline is?

Yes, you don’t have to simply remember your accounts deadline date. You can check when your accounts are due with Companies House at any time by searching for your company on the Companies House register. On the overview tab, you’ll clearly see when your next accounts will be expected by.

What happens if I’ve already missed my accounts filing due date?

If the deadline has already slipped past for you then you won’t be able to request a filing extension. When a company’s accounts are filed late, you’ll need to be prepared to receive an automatic late filing penalty and do be aware that penalties increase the longer it takes for you to submit them. It is for this reason that we would urge you to file your annual accounts as soon as possible. The standard penalty for late filing depends on how late you are:

- £150 if you are up to 1 month late filing

- £375 if you are between 1 – 3 months late filing

- £750 if you are between 3 – 6 months late filing

- £1,500 if you are more than 6 months late filing

What’s more, these penalties will double if you are late filing 2 years in a row, so make sure you follow this guide to request a filing extension in time. If you didn’t get a chance to extend your deadline then you can appeal a late filing penalty instead if you have a valid and legitimate reason.

What are reasonable excuses to apply for a filing extension?

You will need to explain in your request why you require a filing extension. Reasonable explanations are those which are outside of your control and have prevented you from filing your accounts on time which may include:

- A death of a close relation at a time that was close to your filing deadline

- An unexpected stay in hospital that made you unable to deal with your accounts filing

- A serious or life-threatening illness

- Issues with HMRC online services that prevented you from filing your accounts on time

- A fire, flood, or theft that impacted you being able to file your company’s accounts

This is not an exhaustive list but simply examples of the most common reasonably accepted explanations. Be as thorough and detailed as possible when explaining why you were unable to file on time and provide as much supportive evidence as possible such as dates, letters, crime reference numbers, or screenshots.

How to ask Companies House to extend your filing deadline

Online

By far the most straightforward way to request a filing extension for your annual accounts to Companies House is to apply online. The online platform expects the average application to take around 15 minutes to complete. You will need your company number, an email address, details of the reason for your extension request, and any supporting documents to hand when applying.

By Email

For any reason where you’re unable to use the online platform, you can email Companies House directly instead using: [email protected]. Be sure to include your company’s name, company number, and reason for your extension request.This can take longer as the email is not dedicated to solely dealing with filing extension requests. We would advise you to keep records of your email should Companies House not receive it for any reason.

By Post

Alternatively, there is also the option to write and ask Companies House for an extension. Again, include your company name, company number, reason for your extension request and a correspondence address if you expect a reply by post. Send your letter to the appropriate address based on where your company is registered:

- For companies registered in England and Wales: Companies House, PO Box 710, Crown Way, Cardiff, CF14 3UZ

- For companies registered in Scotland: Companies House, 4th Floor, Edinburgh Quay 2, 139 Fountainbridge, Edinburgh, EH3 9FF

- For companies registered in Northern Ireland: Companies House, Second Floor, The Linenhall, 32-38 Linenhall Street, Belfast, BT2 8BG

What happens next?

After you apply to extend your accounts filing deadline, Companies House typically aims to respond within 5-10 working days. However, during peak periods or for complex cases requiring additional evidence, it may take longer. If you have not heard back within this timeframe, it is advisable to follow up with Companies House to check on the status of your application. You will receive a response either way on whether your request has been accepted or rejected.

Where your request has been accepted, you will have until the new deadline date to file your statutory accounts with Companies House. If you miss this deadline, you will receive a late filing penalty. It is important to note that being granted a filing extension does not change your company’s future accounts deadline date as it would if you were to extend your accounting period.

Tips for avoiding late filing penalties

To help you avoid any future late filing penalties, our team of accountants have shared the following tips:

- Sign up to Companies House free email reminders which will send advance notifications of when your yearend accounts and confirmation statement are due.

- Start preparing your statutory accounts as early as possible (as soon as your accounting reference date has passed) so that you have as much time as possible to complete instead of rushing last minute.

- Adopt accounting software to help make completing company accounts easier and save you time. Using dedicated accounting software can help you with time-consuming tasks such as ensuring the correct formatting as well as prompt you to include all the necessary information so that you don’t miss anything out.

- Opt to file online. Although you can still post your accounts to Companies House, filing electronically is not only quicker but more secure. You don’t have to worry about your documents getting lost in the post or postal delays that could result in late penalties.

Get help with your annual accounts submission

If you’re struggling to complete your annual accounts by yourself, then our team of accounting experts based in Oxford and Henley are on hand to assist. Our service ensures that you’re reminded of when it’s time to file, explain what it is we need from you, fully prepare your accounts to the necessary standards depending on your company size and help you file directly with Companies House. To get help with your accounts, just use our contact form.

Stay up to date

Looking for some help?

You can find out more about our statutory accounts preparation service.