How to file a confirmation statement with Companies House

How to file a confirmation statement with Companies House

Quick Links

In the UK, Companies House is a governmental institution which is responsible for incorporating, maintaining, and dissolving limited companies, as well as publishing key company information which is regularly updated in order to promote transparency and legitimacy to the UK economy. To be able to do this, Companies House requires all registered limited companies to submit both statutory accounts and a confirmation statement, in addition to reporting any significant changes to them directly. To avoid getting your company struck off the Companies House register, follow our guide on how to file your confirmation statement.

What is a confirmation statement?

The confirmation statement is a formal document which you must file to Companies House at least once every 12 months and ‘confirms’ a company’s or LLP’s (limited liability partnership) information currently held at Companies House is correct and accurate.

It is not primarily designed for you to make corrections to the company’s information, as these should have been reported at the time, however some amendments can be made. Nevertheless, as best practice it is strongly recommended that you report changes as soon as possible and then confirm these via the confirmation statement where necessary.

What company information needs to be included?

Most of the information that needs to go on your confirmation statement will be about who owns and is responsible for the company’s activities. The good news is that Companies House provides a standardised form (known as form CS01) which means you do not have to remember all the information you need to include and can simply go through the form and fill out the relevant sections. The information that you will need to check and confirm on your confirmation statement includes:

- The company’s registered office as well as Single Alternative Inspection Location (SAIL) address if applicable. A SAIL is an address that you can choose to have your statutory company registers stored at which must be available for public inspection. It’s not always convenient for this to be the same place as the company’s registered address so a SAIL can be listed on the confirmation statement.

- The company’s officers which are the directors, a company secretary (if one is officially appointed), and any members.

- A Standard Industrial Classification (SIC) code. This is an official five-digit code that is assigned to each specific industry and different trading activities that your business may be involved in. You must select the most appropriate SIC code for your business, however in some cases you may choose to list more than one. Companies House provides a full list of available SIC codes to choose from, including specific codes for dormant companies or non-trading companies.

- Shareholder information which includes the names of each shareholder, the amount of shares each shareholder owns as well as the class of shares and any details of share transfers.

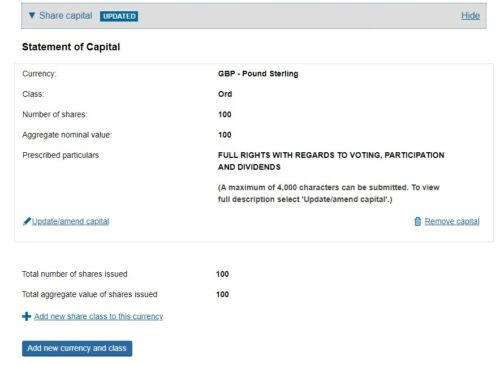

- The share capital, otherwise known as a statement of capital, which is the financial statement that shows the nominal value of the shares in the company – in other words, how much the company is worth in terms of how much money owners have put in. Limited companies are ‘limited by shares’ which means the shareholders are personally liable for the value of what they have put in. Those setting up a new limited company commonly issue 100 shares at £1 each, or even only 1 share at £100 for single one-man band businesses where one person is the sole director and sole shareholder.

- A list of people with significant control (PSCs) unless your company is exempt. A PSC is anyone who holds more than 25% of the shares in a company, holds more than 25% of the voting rights in a company, or has the right to appoint or remove the majority of the board of directors. Even if you are a sole director and shareholder of your own limited company, you must list yourself as a PSC.

What is the annual return and is it the same as a confirmation statement?

You may have come across the term ‘annual return’ and if so, it can sound incredibly similar to a confirmation statement. Sometimes people still refer to an annual return, or use the term interchangeably with the annual confirmation statement. This is because the confirmation statement actually replaced the annual return in June 2016. Although the two fulfil the same function, there are still differences.

The confirmation statement is now much more convenient to complete than the annual return once was. This is particularly true where you have made no changes to your company in the past 12 months, because you can simply state that no changes have been made and that all existing information on the company remains accurate. Whereas with the annual return, you would have to re-complete the entire form each year, even where the details were the same.

What’s more, the confirmation statement now also requires you to publicly disclose any PSCs whereas this was not previously a requirement on the annual return.

As of March 2024, companies are now also obliged to provide a registered email address, but this will not be made available on the public register and is only for Companies House internal use.

How to submit a confirmation statement to Companies House

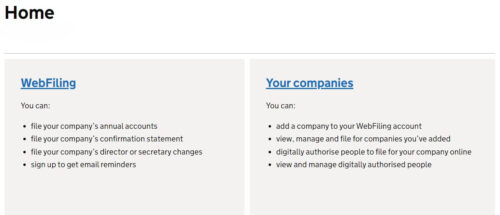

To file a confirmation statement, you can use Companies House’s WebFiling online service. You will need to register for online filing and sign in to do this, but if you are doing so for the first time then you can simply create a new account which will require an email address.

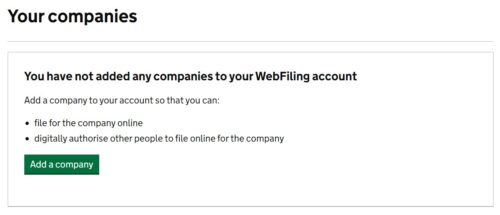

Once you have logged in, there will be two options. If you are filing for the first time you will need to add your company first under ‘Your companies’.

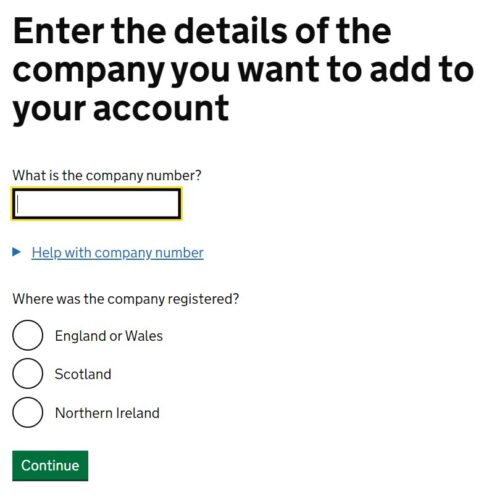

You will need to have your company number, which you can find on the certificate of incorporation that was issued when you registered with Companies House.

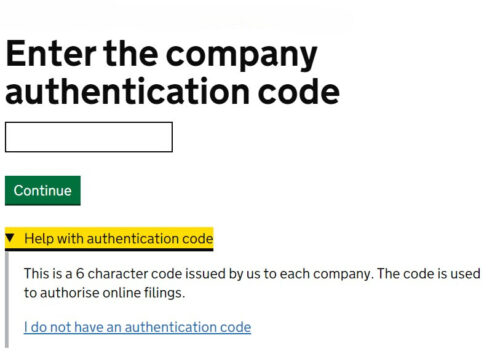

To ensure that you are only connecting to a company you have the permission to file a confirmation for, the WebFiling service will ask you to input the authentication code. This is a 6-digit alphanumeric code that would have been sent to you by Companies House when you registered (note that this will be sent separately to your certificate of incorporation).

Make sure you have your authentication code ready in advance of when your confirmation statement is due. This is because, if you need it to be resent to you, it can take up to 5 working days to arrive by post, and even longer during busy periods. The authentication code cannot be provided by email or telephone.

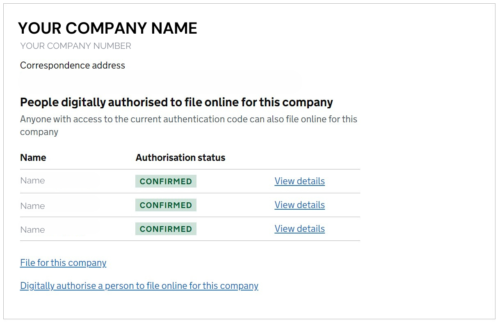

Once you have access, you’ll be able to see all the people who may also have authorisation to file a confirmation statement online for your company. Below, you’ll see the option to ‘File for this company’ which is where you can click to get started.

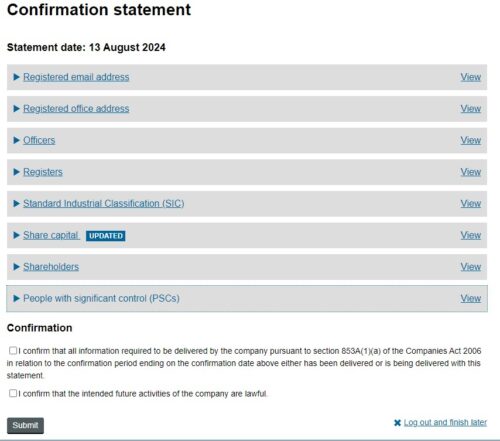

When you go to file your confirmation statement you will see that the page is laid out in separate sections. You should go through each of these sections to ensure that they are correct. If they are, you can simply use the two bottom check boxes to confirm and then click ‘Submit’.

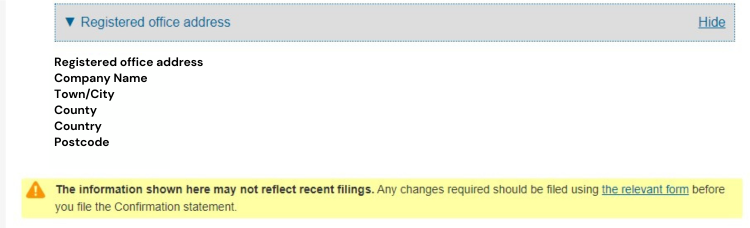

However, if any information is inaccurate and needs corrections you may need to complete the relevant Companies House form for which a link will be provided in each section.

Certain sections may allow you to make changes directly without having to complete a separate form, but it will clearly be indicated by blue icons.

Once you have thoroughly checked each section and you are ready to file your confirmation statement, you can click ‘Submit’ and it’s all done! You will receive an email confirmation which states your confirmation statement has been submitted.

When is my confirmation statement due?

Your confirmation statement due date is yet another deadline day you must remember as part of your company compliance. Unfortunately, it is not the same deadline as it is for your corporation tax return, your corporation tax payment, or even annual account; but all can be submitted on the same day if you choose to do so.

For your confirmation statement, the due date is 14 days after your 12-month ‘review period’. A review period can start on either the date of your company’s incorporation or the date of your last filed confirmation statement. For example, you incorporated a new limited company on 1 May 2023. Your review period starts on this day and ends 30 April 2024. You then have until the 14th May 2024 to file your confirmation statement. Alternatively, say you incorporated on the 1st May 2023 but filed your first confirmation statement on 1st September 2023. This would mean that your updated review period starts on 1st September 2023 and ends on 31st August 2024. Your next confirmation statement would be due no later than 14th September 2024.

You must file a confirmation statement at least once every year as a minimum, but you can also file or update your confirmation statement as many times as you like.

What happens if I’m late filing?

If you have missed the deadline to file your confirmation statement, then not to worry. You won’t receive any automatic fines or penalties, but you will receive an automatic warning from Companies House that you have failed to deliver your confirmation statement. This letter should not be ignored and will serve as a reminder that you need to complete your confirmation statement ASAP! Ignoring this warning could lead to serious consequences.

What happens if I don’t file a confirmation statement?

Failing to file a confirmation statement is a criminal offence. If you do not file a confirmation statement, directors and other company officers may face legal action from Companies House which can include a monetary fine. In the most severe cases, directors and company officers can face prosecution.

Not only that, but Companies House will assume that the failure to submit a confirmation statement is due to the company no longer being in operation. This will lead them to commence legal proceedings for a compulsory strike off from the register. If this occurs, it will mean that your company ceases to exist, and any assets will become Crown property.

Finally, one other potential outcome for failing to file a confirmation statement is that directors can be banned from becoming a limited company director for up to 15 years for failure to meet their legal obligations. This is also known as director disqualification and will prevent you from setting up any new limited companies during the disqualification period.

How much does it cost to file a confirmation statement?

The annual fee to file a confirmation statement with Companies House is £34 (up from £13 as of 1 May 2024) if you file online, or £62 (up from £40, also as of 1 May 2024) if you choose to file via a paper form.

The annual fee covers your entire payment period, which is not the same as your review period explained above. Your payment period covers 12 months starting on the date of your company’s incorporation and the dates cannot be changed.

Paying an annual fee means that you can still file a confirmation statement as many times in a year as you need to but will only be charged once per payment period.

Do I still need to file a confirmation statement if my company is dormant?

Every company is required to file a confirmation statement to Companies House each year, even if your company is dormant. Failure to do so can result in the same consequences as those above for trading companies. So, where you receive a warning letter from Companies House, you should not ignore it just because your company is not actively trading.

Get help filing your confirmation statement

We can help file your statement as part of our company secretarial service, even if your company isn’t trading. If you’re struggling to keep up with your annual compliance obligations, you can trust our thorough and meticulous team of accountants to ensure your company details are up to date and any changes to your company information are reported. Running a business is challenging, especially if you’re doing it all by yourself, but when it comes to everything you need for your business compliance, we can help from your annual accounts to your corporation tax return for HMRC. Get in touch to get a quote for a bespoke package of business support services.