Key Points from the 2023 Autumn Statement

Key Points from the 2023 Autumn Statement

Quick Links

Both optimists and cynic were likely to be following to the Chancellor’s 2023 Autumn Statement announced on Wednesday 22nd November 2023. Not least because we’ve come to expect some kind of “rabbit out of the hat” as they like to call it. However, as per usual, the team at Ridgefield Consulting – Oxford accountants, were left feeling underwhelmed and were waiting for the headlines that were splashed across the news outlets but never appeared.

Nevertheless, here’s what was announced and how it’ll affect you!

The Statement usually begins with a summary of the current economic status. The Chancellor was particularly proud of the three main factors which allows him to determine just how much tax (if any) he can cut:

- Inflation – The Prime Minister, Rishi Sunak, pledged to halve inflation by the end of 2023. Inflation stood at over 11% last autumn but is now at 4.6% this October 2023. Whilst he takes credit for the early success of his promise, there are some which insist the government have little impact on inflation.

- Debt and borrowing – The Chancellor has managed to wrangle the numbers down to meet his debt and borrowing fiscal rules despite this October being the second highest ever in state borrowing costs. However, overall debt was £16.9 billion less than the forecast £115.2 billion predicted by the Office for Budget Responsibility (OBR).

- Economy – Instead of sliding into a recession, the UK’s economy has fortunately been more resilient than expected. The OBR has revised its prediction for the current financial year from a collapse of 0.2% to a growth of 0.6%. Hunt announced that the economy further forecast to grow by 0.7% next year with continued growth each year up to 2027.

Next, Jeremy Hunt followed with what he hoped to be his crowd-pleasing measures:

National Living Wage

The Chancellor used the 2023 Autumn Statement as an opportunity to confirm plans for increasing the National Living Wage which were first announced during the Conservative Party Conference back in October 2023. The National Living Wage will see its highest increase by almost 10%, up from £10.42 per hour to £11.44 per hour. It was previously applied to workers aged 23 and over but now will be extended to those from age 21 and above. The National Minimum Wage – which is applied to workers between the ages of 18 – 20 years old sees an increase from £7.49 per hour to £8.60 per hour. Finally, apprentices also receive a wage increase from £5.28 to £6.40. All are to come into force from April 2024.

State Pension

There were previously concerns over how the government would calculate the next state pension rise due in April 2024, with many speculations that the numbers would be manipulated in order to reduce the increase. However, in the end, the Chancellor decided in favour of appeasing the public and maintained the pension triple lock pledge. This is where the state pension rise is promised to increase by whichever is the highest between average annual earnings growth from May to July, inflation in the year to September, or 2.5 per cent. In April 2024, the state pension will rise by 8.5% which is the average annual earnings growth (with bonuses factored in).

R&D Tax Credits

The team were excited to hear the inclusion of R&D tax credits in the Chancellor’s autumn statement but were disappointed by the lack of any new revelations. Once again, he confirmed his commitment to growing the economy through innovation and investment and aims to increase R&D spending by £20 billion by 2024/25. Overall, there are no new changes since the April 2023 R&D Tax Credit changes. The team were particularly frustrated that there was no mention or acknowledgement of the delays in processing R&D claims since the new procedures were put in place, or how the government planned to tackle them. In our opinion, the bottleneck has a huge impact on productivity.

Business Rates

To support small businesses and the local high street, the Chancellor has announced a package worth £4.3 billion to be available over the next five years. This includes freezing the small business multiplier and extending the Retail, Hospitality and Leisure (RHL) relief which enables eligible businesses to receive 75% off their business rates bill up to a maximum of £110,000 per claimant. It is not yet clear how long the relief has been extended for. However, amongst supporting smaller businesses, the Chancellor has stated his intention to increase the standard rate multiplier in line with inflation.

Full Expensing

As part of the Chancellor’s plan to increase investment in British businesses, he claimed he is offering “the largest business tax cut in modern British history”. Full expensing was first introduced in the 2023 Spring Budget and was due to be temporarily available until 31 March 2026. However, during this Autumn Statement, the Chancellor has now made full expensing permanent. Full expensing allows businesses that purchase qualifying equipment to deduct 100% of the cost of it against their profits in the same tax year. It means that for every £1 million a company invests in eligible equipment, £250,000 is deducted from their tax bill. This makes the UK’s capital allowances regime one of the most generous in the world.

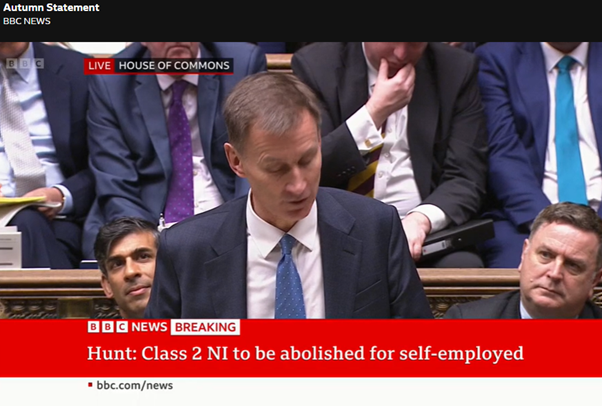

National Insurance for the Self-Employed

One of the Chancellor’s most crowd-pleasing measures in his 2023 Autumn Statement was the abolition of Class 2 National Insurance (NI) for the self-employed. It’s calculated to save the average self-employed worker £192 per year. Hunt assures us that this will not remove a worker’s eligibility for receiving benefits or the state pension and that self-employed workers are still free to make voluntary contributions. Class 4 National Insurance which must be paid by all those who are self-employed earning £9,569 or more a year will see a 1% cut in rate, having to only pay 8% on profits between £9,501 to £50,000. The 2% surcharge for those with profits over £50,000 is expected to remain.

National Insurance for Workers

Continuing with tax cuts, the Chancellor also made cuts to NI for employed workers. Class 1 NI will be cut from 12% down to 10%, saving workers on the average salary of £35,000 a year more than £450 a year. Hunt extended his generosity by pledging that this change would come into force from 6th January 2024 instead of 6th April 2024.

What’s noticeable however is that he did not choose to offer any relief to employers’ NI. The Labour party also criticised these changes pointing out that Hunt only raised NI across the board by 1.25% last year in April 2022.

What was not included in the 2023 Autumn Statement?

Finally, to conclude, it must be mentioned that what was clearly omitted from the Chancellor’s 2023 Autumn Statement were mentions of inheritance tax and income tax. Whilst there were many reports on the plans to scrap inheritance tax, Hunt failed to reveal these in his announcement. Labour’s Shadow Chancellor has questioned whether these plans have simply been postponed to a more impactful time (insinuating that it would be pulled out closer to the time of the next general election) or whether it had been abandoned altogether.

Any changes to the income tax thresholds as well as personal allowance were also prominently missing from Hunt’s plans. Fiscal drag has long since been an effective strategy to bring in more taxes and again, Hunt may be reluctant to pull that rabbit out of the hat until the time comes for when it is truly needed to secure the Conservative’s next term in leadership.

For more news and updates, please subscribe to our monthly email newsletter.